1031 tax deferred exchange meaning

Learn more about REITs for like kind exchanges. We will make it even simpler and cover four common misconceptions about 1031.

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Learn more about REITs for like kind exchanges.

. As with all of the tax deferral strategies there are certain rules to follow so that. If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange. Why deal wtenants toilets trash.

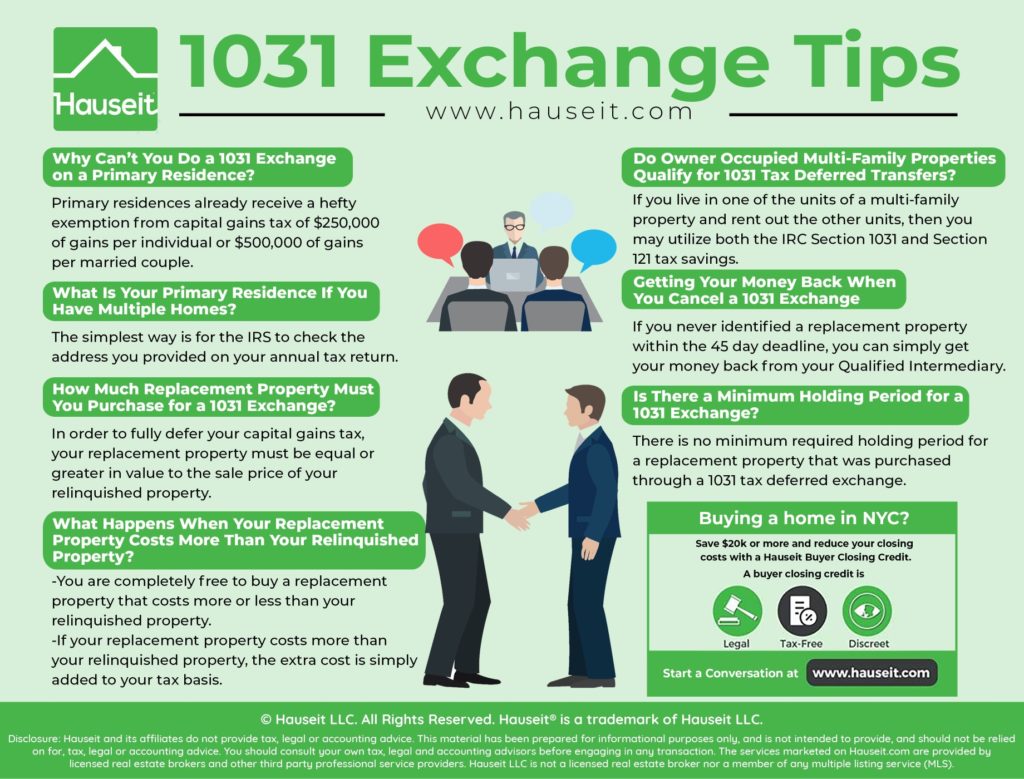

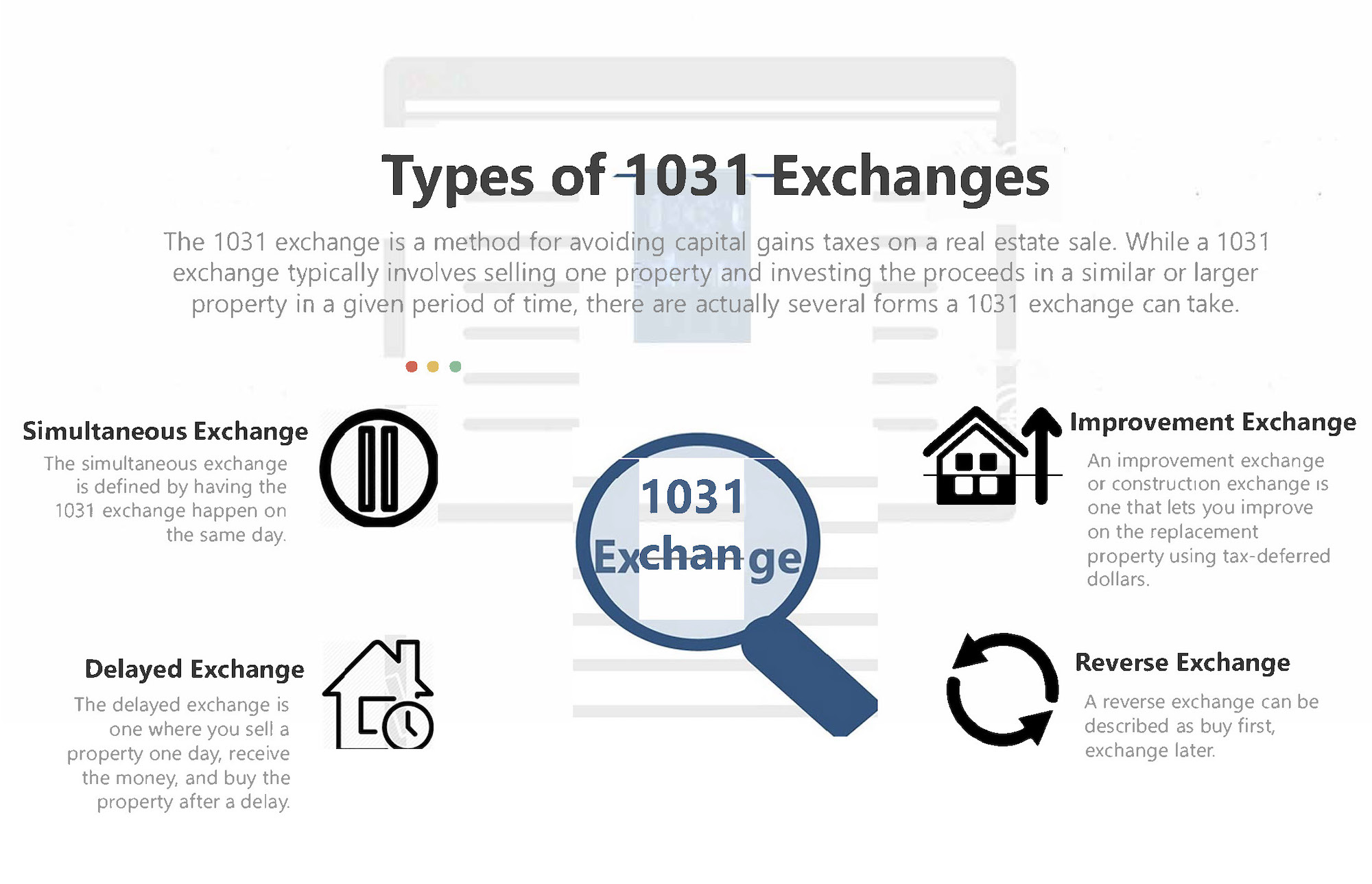

No-hassle passive income now. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while. There are many benefits to a 1031 exchange and theyre much simpler than most people think.

You can do a 1031 exchange into a REIT. Ad Request Information On Unique 1031 REIT Exchange Programs. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

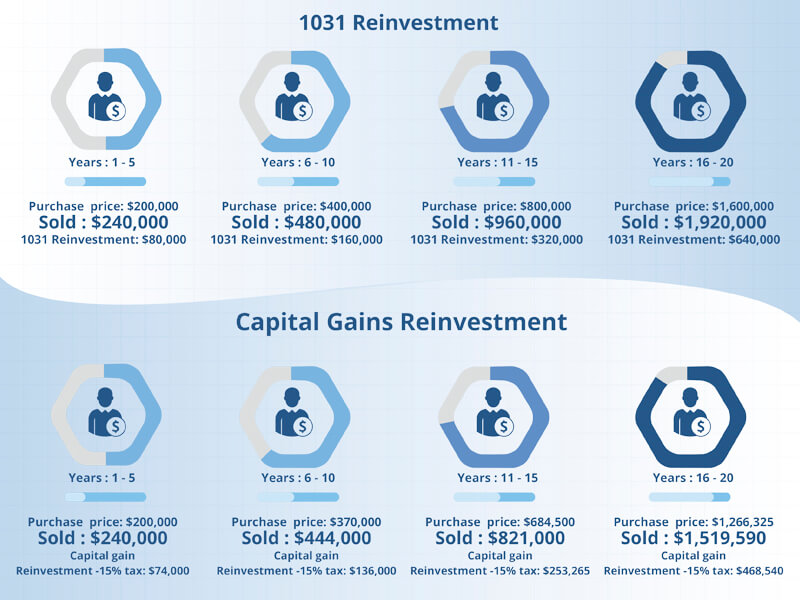

A 1031 exchange allows you to defer gains taxes on a property that you sell. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties. A 1031 exchange allows real estate investors to sell one property and roll those proceeds into a like-kind replacement asset.

Basically a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits. By doing this investors can defer tax liabilities. Why deal wtenants toilets trash.

Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. You can do a 1031 exchange into a REIT. 1031 Tax-Deferred Exchange Definition For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

What Is a 1031 Exchange. For the most part I think I understand the basic idea of a 1031 Exchange. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow.

This is a procedure that allows the owner. Ad Request Information On Unique 1031 REIT Exchange Programs. If assisting with your Section 1031 tax-deferred exchange Fyntex cannot advise the owner concerning specific tax consequences or the advisability of a tax-deferred exchange for tax.

The exchange can include like-kind property exclusively or it can include like-kind property along with cash liabilities and property that. You sell one property and to avoid paying cap gains tax you thFor the most part I think I. No-hassle passive income now.

Those taxes could run as high as 15. The termwhich gets its name from Internal. Section 1031 is tax-deferred but it is not tax-free.

In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

6 Steps To Understanding 1031 Exchange Rules Stessa

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

1031 Exchange What Is It And How Does It Work Plum Lending

1031 Exchange Rules How To Do A 1031 Exchange In 2021 Jones Hollow Realty Group

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

1031 Exchange When Selling A Business

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

1031 Exchange Faqs 1031 Exchange Questions Answered

What Is A 1031 Exchange Asset Preservation Inc

What Is A 1031 Exchange Mt Helix Lifestyles Real Estate Services Jason Kardos Broker

1031 Exchange How You Can Avoid Or Offset Capital Gains

What Is A 1031 Exchange Mark D Mchale Associates

The Tax Deferred Exchange Ipx1031

What Is A 1031 Exchange Properties Paradise Blog

Are You Eligible For A 1031 Exchange

What Is A 1031 Exchange Commercial Real Estate Md Va Dc